Mortgage Market Update

I felt compelled to put pen to paper and give my thoughts on the current situation to help anyone who is currently in a state of panic about what might happen to their mortgage payments in the short, medium and long term. Please take the time to read until the end, where I will share all of my thoughts on this.

As we are all aware, the UK economy has been experiencing high levels of inflation for some time, predominately caused by the increase in the cost of energy bills. Here is a graph to illustrate the levels of inflation compared with previous years:

To combat inflation, the Bank of England has a few tools it can use but the most commonly used approach is to increase the base rate, which it has done at the last seven consecutive meetings.

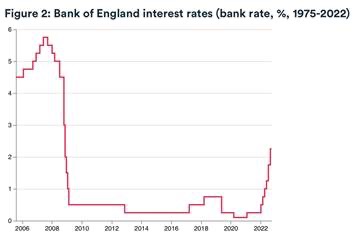

Here is a graph to illustrate the BOE base rate movements, clearly showing the upward trajectory for interest rates since the beginning of 2022.

Here are the increases that have taken place this year and the dates they occurred:

| Date Changed | Rate |

| 22-Sept-22 | 2.25% |

| 04-Aug-22 | 1.75% |

| 16-Jun-22 | 1.25% |

| 05-May-22 | 1.00% |

| 17-Mar-22 | 0.75% |

| 03-Feb-22 | 0.50% |

In the last 8 days, we have experienced a sequence of events that is like no other. I am sure many of you will have been following the news but, if you haven’t, this is how it began.

Thursday 22nd September

The Monetary Policy Committee (MPC) voted to increase the Bank of England base rate from 1.75% to 2.25%, which was received well by the markets as a larger jump of 0.75% had been priced in. The Committee also voted unanimously to reduce the stock of purchased UK government bonds, financed by the issuance of central bank reserves, by £80 billion over the next 12 months.

Friday 23rd September

The new Chancellor of the Exchequer, Kwasi Kwarteng, announced some changes in a mini-budget.

The major changes that were announced are as follows:

- The 45% additional rate of income tax for those earning more than £150,000 has been scrapped

- Stamp duty cuts are targeted at helping first-time buyers

- The planned increase in corporation tax has been canceled and it will remain at 19%

- The recent increase in National Insurance is to be reversed

- A cap on bankers’ bonuses has been lifted

- Energy bills for the average home are to be capped at £2,500 per annum

The theme of the mini-budget was mainly about getting Britain’s economy growing again and this involves a theory known as trickle-down economics. Effectively, what was announced was a vast amount of tax cuts, which the government would need to fund by borrowing more money.

If you want to read the specifics about the changes made, here is our blog post covering each change in more detail:

https://www.trinityfinance.co.uk/what-changes-have-been-announced-in-the-mini-budget/

Monday 26th September

This is when it all started to go wrong. The tax cuts that were announced were not costed out to prove that the government’s plan will actually work. Normally, prior to a fiscal event, the Office for Budget Responsibility will assess the plans, cost them out and give their approval. The government decided this was not necessary and so the announcements were made without truly knowing what impact they would have.

The markets started to panic and the £ neared parity against the $ as it slid to 1.035.

Next, the International Monetary Fund (IMF) issued a statement warning the UK government that they are heading down a very dangerous path. They warned them to turn back, which was seen as a form of global embarrassment for the UK government’s actions.

A number of mainstream mortgage lenders announced that they are withdrawing from the market due to the current uncertainty, including Virgin Money, Skipton, Halifax, Clydesdale, BM Solutions and others.

The Bank of England issued the following statement:

“The MPC will not hesitate to change interest rates by as much as needed to return inflation to the 2% target sustainably in the medium term, in line with its remit.”

Wednesday 28th September

In a complete U-turn the Bank of England announces a two-week purchase for long dated bonds and delaying its planned gilt sales which had been announced only a week ago on Thursday 22nd September. The move came after a massive sell-off in government bonds which took place swiftly after the governments unfunded tax cutting announcements in the mini budget.

Monday 3rd October

The chancellor has U-turned on plans to scrap the 45p rate of income tax. We now wait to see how the markets react to the U-turn. Kwasi Kwarteng says “a massive distraction on what was a strong package”

It’s the Tory Party Conference this week and all eyes will be on Wednesday 5th October as that’s when Truss and Kwarteng make speeches. I understand they’re going to do them late afternoon or evening so the markets don’t have time to react while they’re speaking. There will be no OBR report given, just rhetoric and potential policy announcements. If there’s more commitment to borrowing made then the markets will not like this as there will be no OBR based independent information given to explain the numbers.

Since this complete chaos at the beginning of the week, we have now pretty much seen the majority of mortgage lenders withdraw completely from lending or withdraw and then re-enter the market at a much higher level. Next week, we will see more lenders start to come back but the consensus is that rates will be offered that start at 5.5%.

Let me point something out about how mortgage rates are calculated. Without getting too technical, when lenders offer a mortgage, they typically look at the swap rates at the time to determine what level of risk/profit they wish to take before lending the money out.

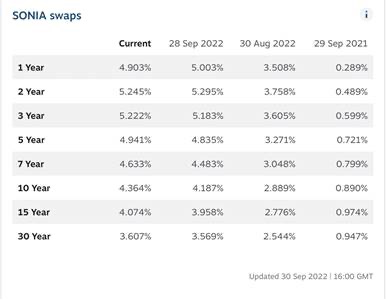

Here are the latest SONIA swap rates taken from the following website, which is constantly being updated.

Latest market swap rates: https://www.chathamfinancial.com/technology/european-market-rates

You can see from this image that the current 5-year swap rate is just under 5% at 4.94%. This has completely spooked all the lenders as 30 days prior to this, the same swap rate was 3.27%. No wonder the lenders have exited the market and are now repricing. Some lenders have re-entered the market quickly but others are sitting on the sidelines and observing.

Currently, if nothing drastically changes, the UK BOE base rate is assumed to rise rapidly to 6% by early 2023 before later being reduced gradually to under 3.5%. No one can be certain that this is what will happen but it’s predicted that this will be the path we will be following.

I have had record numbers of clients and friends calling me about what to do and many are, rightly so, panicking. I firmly believe that this is a temporary crisis and the most important thing right now is to remain calm and not make any irrational decisions. Many of us are considering paying early repayment charges and switching early, and for some people that may well be the right decision but for others, it is absolutely not.

If you have a fixed rate that is expiring this year or in 2023, then you, along with myself, are one of the unfortunate ones that have not benefitted from this timing. You will have options to consider that include staying with the existing lender and fixing, staying and going to the lender’s variable rate or remortgaging with another provider. BOE trackers are worth exploring for some while for others a fixed rate is the best route to go down.

We need to be realistic with ourselves right now and the truth is that in the short term, mortgages for everyone will be considerably more expensive when our fixed rates expire. I would strongly encourage you to have a detailed look at your income and expenditure. This is a great exercise to see what is coming in and going out and will then let us see how an increase in your mortgage payments will affect your finances.

We can also help you if you cannot afford a substantial jump by exploring options such as increasing your mortgage term or converting to an interest-only mortgage. Both of these options have major disadvantages but, sometimes, needs must. If you are one of the unlucky ones to have a fixed rate expiring in the short term, I feel that it is now time to be prudent and assess your own situation fully so that you can make an informed decision about what is best to do.