What is Checkmyfile?

When applying for a mortgage, the better your financial health, the better the outcome. Lenders need to check your creditworthiness before approving your application. They do this by checking your credit report. If this shows a low credit score, a lack of credit history or an adverse credit rating, it can affect your eligibility for a mortgage or the rates you are offered. It’s imperative, therefore, to check your credit report before applying for a mortgage. That way, you’ve got time to improve your credit rating where you can, increasing your chances of a successful outcome.

At Trinity Finance, we tackle any credit report issues head-on by requiring a full multi-agency credit report from Checkmyfile for each person on the mortgage application. This enables us to see what information lenders can view across the UK’s three main credit reference agencies. It helps us to spot and fix any issues before we submit your mortgage application. Doing so ensures that your mortgage application can progress efficiently by reducing unexpected delays and it also helps protect your credit file.

In this guide, we explain what Checkmyfile is, how it works, the information displayed on the credit report, the importance of using Checkmyfile and how it compares with other credit reference agencies.

Disclosure: This guide contains affiliate links, which means that we may earn a small commission at no extra cost to you if you click through and use the services.

What is a credit score?

Before delving into Checkmyfile, we’ll explain what a credit score is and its significance when applying for a mortgage or remortgage. Your credit score is based on your financial behaviour, with your creditworthiness being given a numerical representation. This typically ranges from 0 to 1,000.

A higher credit score

A higher score is achieved by having good financial habits. For example, making repayments on time, ensuring that at least the minimum amount due is paid each time, refraining from maxing out any lines of credit and only applying for credit that you need. With a good credit score, lenders can see that you have a good history of borrowing and are less likely to default on your mortgage payments. This makes it easier to be approved for a mortgage. You may also be offered more competitive interest rates and better terms, such as more beneficial repayment terms and higher borrowing limits.

A lower credit score

A lower credit score, however, increases a lender’s risk as it shows a higher risk of defaulting on the mortgage. There are numerous reasons why you may have a low credit score, including a lack of borrowing history, making too many credit applications in a short period, making late payments, having mortgage arrears, a debt management plan being in place, having filed for bankruptcy, having CCJs or defaults registered against you and more.

With a low credit score, lack of credit history or bad credit, it can be much harder to be approved for a mortgage. A glance at your credit score enables lenders to determine your risk as a borrower, although other factors are considered too, such as your income, expenses and outstanding debts. Our expert brokers can guide you on ways to improve your credit score before applying for a mortgage. If you still have credit issues at that point, they can approach lenders who are better-equipped at dealing with an adverse credit history. The flexibility of these lenders when assessing your creditworthiness can significantly improve your chances of having a successful application.

How do credit scores work?

Your credit history information is taken from various sources by credit reference agencies and is collated in your credit file. These sources include the electoral roll, loan providers, banks, public records and debt collection agencies. There are three main UK credit reference agencies — Experian, Equifax and TransUnion. They look at the information in your file to generate a credit score. This is based on various factors, such as the types of credit accounts you have, the length of your credit history, your payment history and more.

Each credit reference agency assesses you in a slightly different way, which means that your credit score can vary between them. Their ranking categories for credit scores also differ. For example, a score assessed by one of them may be considered ‘good’ but the same score may be considered ‘excellent’ by another. To be more specific, Equifax uses a scoring system of 0 to 700, TransUnion from 0 to 710 and Experian from 0 to 999. This in itself makes it confusing to compare the scores shown on each credit report.

When checking your credit report, lenders can approach any of these credit reference agencies and it’s unlikely that you’ll know which one. This means that you need to try and keep your credit record held with each credit reference agency as up to date as possible.

Lenders also analyse your credit score differently, each having their own criteria and factoring in other aspects, such as your income and any outstanding debts you have. Therefore, it’s recommended to check your credit report regularly and improve your score wherever you can to optimise your position.

Why use Checkmyfile?

Checkmyfile provides you with more accurate results than the individual credit reports held by the UK’s three main credit reference agencies. This is especially the case as there can be discrepancies between them. For example, a missed payment may have been registered on your credit report for Experian but it may not have been recorded on your report for Equifax. As lenders favour different credit reference agencies, this can be worrying when it comes to the assessment of your creditworthiness. Checkmyfile, however, pulls details from Experian, Equifax and TransUnion. Therefore, you can be sure that all of the relevant information has been included, giving you a more accurate report.

If you see any incorrect information, you can amend it swiftly so that it doesn’t negatively impact your credit score. Checkmyfile shows you where there’s room for improvement with your credit score, enabling you to act on this straight away. With your detailed credit report at your fingertips, you can be proactive in managing your profile and improving your financial health. This gives you more confidence when applying for a mortgage and potentially opens up more opportunities with lenders.

The accuracy provided by Checkmyfile is essential from our point of view as mortgage brokers. Before submitting your mortgage application, we can get a clearer overview of your financial health and conduct a more accurate assessment. The comprehensive credit report enables us to spot any issues quickly and aim to resolve them before submission. For example, there may be name or address mismatches that need to be corrected or some of the data may be outdated, which needs to be resolved.

How does Checkmyfile work?

Every month, Checkmyfile updates your credit report by taking data from each of the UK’s three main credit reference agencies – Equifax, Experian and TransUnion. This compiled data provides you with a single, more comprehensive report, giving you access to a more accurate view of your financial profile and credit history. The report can include the following information:

- Credit accounts, such as loans, phone contracts, mortgages and credit cards

- Payment history, including on-time, late and missed payments

- Electoral roll registration

- Public records, such as county court judgements (CCJs), defaults, insolvencies and bankruptcies

- Financial associations and linked financial accounts. For example, you may have had an account with an ex-partner, which is still showing on your report.

As the three credit reference agencies each collect and report data differently, this single report makes it easy to identify any discrepancies and act on them. With instant access, you can also monitor it for any changes. This is a good way to detect signs of fraud or identity theft.

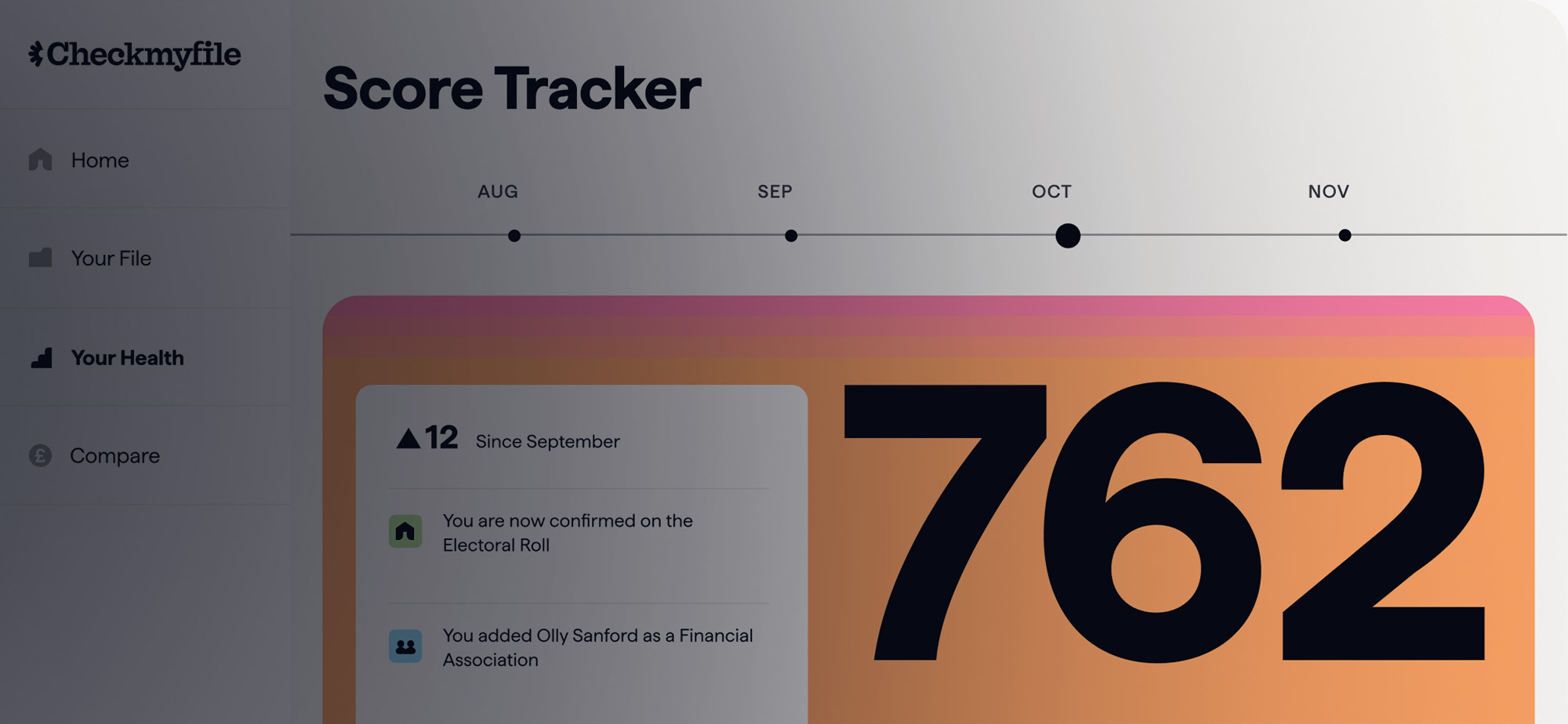

Calculating your credit score

Checkmyfile calculates a unique credit score based on the information received from each of the three credit reference agencies. The scoring system ranges from 0 to 999 and the higher your score, the better your credit health. The Checkmyfile score takes into account:

- The length of your credit history. A lack of credit history or none at all lowers your credit score.

- Your payment history. This tracks whether you make payments on time and includes payment information for up to the last 6 years. Any late or missed payments negatively affect your credit score.

- The types of credit accounts you have. These can include credit cards, phone contracts, mortgages and other instalment loans, payday loans and more.

- Your credit utilisation. This focuses on how much you are using of your available credit. Too much indicates that you may be under financial strain. Using more than 30% can negatively affect your credit score.

- Any recent credit applications you’ve made. Making too many credit applications in a short period can lower your credit score. It signifies that you’re unable to manage your finances well.

- Information from public records. This can include details of defaults, insolvencies, bankruptcies and CCJs. Any of these can negatively affect your credit score.

How do you sign up for Checkmyfile?

It’s quick and easy to set up a Checkmyfile account and access your credit report.

- Open an account: Click here to visit the website, then click on the ‘Sign up’ button. Enter your email address and a password, then tick the box underneath to confirm that you accept the terms of use and privacy policy. Click ‘Continue’ to begin your 30-day free trial. (When the free trial expires, it costs £14.99 per month and you can cancel at any time.)

- Enter your personal details: These include your full name, date of birth, current address, address history and payment information. The latter is for verification purposes and to enable a smooth transition when becoming a subscriber once the Checkmyfile free trial has ended. No payment will be taken during the free trial period.

- Verify your identity: You’ll need to answer some on-screen security questions to confirm your identity.

- View your credit report: Once the verification process has been completed, you’ll be able to access and view your credit report. You can also download a copy if you want to.

Review and correct your credit information

Once you’ve accessed your credit report, check the information carefully to ensure that there are no errors. This includes your payment history, current credit accounts you hold, financial associations and public records, such as CCJs and debt relief orders. If there are any errors, Checkmyfile can guide you on how to amend them.

Checkmyfile also details how each aspect of your report affects your credit score. It identifies actions that you can take to begin increasing your score. Once this has happened, it continues to guide you on how to maintain a higher credit score.

When you start monitoring your credit report regularly and notice any changes that occur, this will help you make more informed financial decisions.

How do you send someone your Checkmyfile credit report?

If you wish to send someone a copy of your credit report, you can save it as a PDF. Follow the steps below, depending on whether you’re using a desktop PC, an iOS device or an Android device.

Desktop PC:

- Click ‘Print/save my file’, which you’ll see at the bottom of the Home page.

- Click ‘Print/Save’ and you’ll see the print options.

- Select ‘Save as PDF’ from the drop-down list.

- Click ‘Save’.

- Select where you want to save the PDF and click ‘Save’.

iOS device:

- Click ‘Print/save my file’, which you’ll see at the bottom of the Home page.

- Click on the share icon in your Internet browser.

- Click ‘Options’.

- Select ‘PDF’ from the list and then click ‘Done’.

- Click ‘Save to Files’ and then select where you want to save the PDF.

Android device:

- Click ‘Print/save my file’, which you’ll see at the bottom of the Home page.

- Click ‘Print/Save’ and you’ll see the print options.

- Select ‘Save as PDF’.

- Click the download PDF icon.

- Select where you want to save the PDF and click ‘Save’.

At Trinity Finance, we need a full multi-agency credit report from Checkmyfile for each person on the mortgage application. Therefore, for a joint application, we require a separate PDF for each applicant. This enables us to progress your mortgage application efficiently.

Latest Testimonials

Speak to an expert Mortgage adviser from Trinity Finance

Our specialist mortgage brokers are here to guide you through the entire mortgage and finance process, helping you secure the best mortgage deal tailored to your needs.

Louis Chalk

Associate Director

Emma Taylor

Mortgage Consultant

Omer Mehmet

Managing Director

FAQs

What is a good credit score on Checkmyfile?

Checkmyfile uses a scoring system of 0 to 999. The UK’s three main credit reference agencies each have different scoring systems. Rather than averaging your score across the three reports, Checkmyfile accounts for the rest of the information provided to calculate a unique credit score that gives an overview of your financial standing. This score represents your likelihood of defaulting, which gives you an idea of how a lender will view you when checking your creditworthiness. Checkmyfile’s scoring system is broken down into the following credit score bands:

|

Checkmyfile credit score |

Likelihood of defaulting |

|

Up to 449 |

38% |

|

450–639: |

24% |

|

640–719: |

15% |

|

720–829: |

8% |

|

830–900: |

4% |

|

Over 900: |

2% |

Having a higher score reflects that you have a better credit rating and makes it easier to be approved for a mortgage. The higher your score, the more likely you are to be offered a higher loan-to-value (LTV) ratio by a lender and benefit from a better interest rate.

However, it’s important to understand that a lower score doesn’t mean that you won’t be accepted for a mortgage. Lenders look at your credit score to help determine your reliability for repaying the mortgage loan. But they have their own criteria and also take other factors into account, such as your income, the amount of deposit you can pay, the security you can provide and any existing debts you have.

How often does Checkmyfile update?

Checkmyfile updates your credit report each month so, at that point, it will show the up-to-date information from each of the UK’s three main credit reference agencies. Lenders and banks generally update their information about you on a monthly basis, whether that’s for an overdraft facility, a credit card, a new account that’s been opened, a mortgage, a personal loan, a line of credit, etc. This information can include details of your balances, repayment times, credit limits and more. This means that any changes to your accounts will reflect quickly in your Checkmyfile credit report.

However, lenders update their information at different times and each credit reference agency updates its system at different times. Therefore, you may be expecting a change to appear on your Checkmyfile report that doesn’t actually show until the following month. As Checkmyfile gives you an overview of your financial standing with all three credit reference agencies, it still gives you the most comprehensive idea of what a lender can see when checking your creditworthiness.

What is a multi-agency credit report?

Checkmyfile gathers your data from the UK’s three main credit reference agencies – Equifax, TransUnion and Experian – and creates a single, multi-agency credit report. This enables you to see all of the information from each of the credit reference agencies in one place. When you’re preparing to apply for a mortgage, a multi-agency credit report can be an invaluable tool. You can quickly get to work improving your credit score, whether that’s correcting any inaccuracies, reducing some of your loans or closing unused credit accounts.

The three credit reference agencies all collect and record data in different ways. This means that the information displayed on each report can differ, including your credit score. It’s both hard and time-consuming to make comparisons between them. With a multi-agency credit report from Checkmyfile, you have a unique credit score, a more detailed report and it’s much easier to spot any discrepancies. The comprehensive report allows for easy monitoring of your credit rating and tracking of any credit improvements. It’s also a good way to spot unusual activity, which may point to potential identity theft issues.

Is Checkmyfile accurate?

Checkmyfile pulls your credit data from each of the three main credit reference agencies. Each of them differs in their collection and reporting of data so each of your individual reports will vary slightly. This can lead to a potentially inaccurate view of your creditworthiness if just one of them is checked by a lender when assessing you for a mortgage. Having them collated together in Checkmyfile gives a more balanced and accurate representation of your credit history. As Checkmyfile is updated monthly, you also have the most accurate credit report at the time it’s updated.

From our point of view as mortgage brokers, the comprehensive report provides a more strategic overview of your finances, enabling us to conduct a more accurate assessment before submitting your application. Any errors can be amended and other potential issues can be tackled immediately. That way, your credit health is optimised as much as possible, helping to gain a more favourable mortgage outcome.

How much does Checkmyfile cost?

When you sign up for Checkmyfile, you’ll get a free trial for 30 days. This is perfect when you’re applying for a mortgage as you can check your credit report and take any necessary action to improve it before your mortgage application is submitted. This ensures that your credit report is the best it can be at the point a lender carries out their check on you.

You may, for example, have a positive credit score but it’s borderline for some lenders. Your Checkmyfile credit report enables you to spot any inaccuracies easily and it highlights areas that can be improved. With just a few tweaks, you may be able to increase your credit score. Ways to do this can include having an old financial link with someone removed, closing unused credit accounts, reducing an outstanding debt or registering on the electoral roll. The better your credit score, the wider your choice of lenders, the easier it is to be approved for a mortgage and the better the interest rates you’re offered.

If you decide not to continue using Checkmyfile at that point, you can cancel it before your free trial ends so that you’re not charged a subscription fee. Should you wish to keep using it, however, you’ll be charged £14.99 per month. As your credit report is ever-evolving, this can be well worth doing. You can track how your credit score changes over time and this can help you shape your financial habits using informed decisions. If you later decide you no longer wish to use Checkmyfile any more, you can cancel your subscription at any time.

How do you cancel Checkmyfile?

You can cancel your Checkmyfile subscription at any time and there are a few different ways you can do this. One is to send an email to the customer service team at help@checkmyfile.com. Another is to send a secure message via your account, asking for your subscription to be cancelled. Alternatively, you can log in to your account on your mobile or desktop PC and cancel your subscription in the billing section. To do this:

- Click on your initials — these will be at the top-right of the page on your mobile or the bottom-left of the page on your desktop PC.

- Click on the ‘Billing’ tab.

- Click ‘Cancel’.

Follow the onscreen instructions and then you’ll receive confirmation of the cancellation via email and a secure message from Checkmyfile.

Do mortgage lenders use Checkmyfile?

Lenders refer to their preferred credit reference agencies – usually one or two – when running their checks on you to help them make a lending decision. These agencies all collect and record data in different ways so your credit reports will vary between them. Lenders take into account your credit score and credit history but also have their own criteria and generally use their own credit score system. As such, they use this rather than the credit scores provided by the agencies.

Lenders don’t use Checkmyfile to guide them on lending decisions but, as the platform collects your credit data from the three main credit reference agencies, it gives you a comprehensive overview of what lenders can see. It’s an essential tool, therefore, that allows you to review your report before applying for a mortgage. It gives you time to remove any inaccuracies and improve your credit score where you can. Changing just one aspect, such as closing an unused credit account, may just push you from being on the boundary of acceptance by a lender to being approved for a loan.

What is the highest score on Checkmyfile?

Checkmyfile collects your credit data from the UK’s three main credit reference agencies and produces a unique credit score. This can range between 0 and 999, with 0 being the lowest score and 999 being the highest. Checkmyfile bases this score on your likelihood of defaulting so that you can see how a lender will view your creditworthiness.

For example, if you have a credit score between 0 and 449, there’s a 38% likelihood of defaulting according to Checkmyfile’s metric. In this case, it can be more challenging to be approved for a mortgage as you present a higher level of risk to the lender. As such, Checkmyfile will recommend that you take steps to improve your credit score. Don’t be disheartened if you have a low score as there can be many reasons for this. Lenders also take other factors into account when assessing you. If you have bad credit, we deal with specialist lenders who offer more flexibility with their criteria for a mortgage.

At the other end of the scale, with a Checkmyfile score of over 900, there’s only a 2% likelihood of defaulting. This means that you should be approved for a mortgage, be offered a higher loan-to-value (LTV) ratio and benefit from a competitive interest rate.

How is your personal information used by Checkmyfile and is it safe?

Checkmyfile displays your personal information and financial data in a multi-agency report to give you a comprehensive overview of your credit health and financial standing. This information can include your name, address history, whether you’re registered on the electoral roll, details of financial associations, your payment and borrowing history over the last 6 years, public records, such as CCJs or bankruptcies, details of recent searches carried out on your credit report and fraud alerts.

Checkmyfile is registered and regulated in the UK and is safe to use. It follows strict protocols to ensure the privacy and safety of your information. It employs the use of secure servers, industry-standard encryption and two-factor authentication. Its regular credit monitoring service can also alert you to any unusual activity. For example, it may highlight an unexpected search, indicating that someone has used your name to apply for credit. Or it may show an unrecognised credit account, such as for a credit card, which you didn’t open. This information enables you to identify potential identity theft or other fraudulent activity and act on it quickly.

Contact Form

Mortgage Lenders

Partner with specialist lenders who understand finance